Kay Guinane is the Director of the Charity & Security Network. She is a public interest attorney specializing in the rights of nonprofit organizations, particularly in the areas of free speech, association and national security. She has published research, testified before Congress and the Federal Election Commission, and engaged extensively in advocacy and consulting on nonprofit and national security issues in the U.S. and abroad. She serves as Co-Chair of the Global NPO Coalition on FATF.

In February 2017, Charity & Security Network released the first-ever empirical study of the global phenomenon known as "derisking," as it relates to U.S.-based NPOs, entitled “Financial Access for U.S. NPOs”. This report revealed that the scope and prevalence of challenges that U.S.-based nonprofits face in accessing financial services are far more vast than previously understood, with two-thirds of U.S.-based nonprofits working abroad facing problems. The issues they face include delays in wire transfers, account closures and account refusals, requests for unusual additional documentation and increased fees. WPP staff spoke to C&SN Director Kay Guinane on what led to this research, what the findings have uncovered and what this means for NGO financial access moving forward.

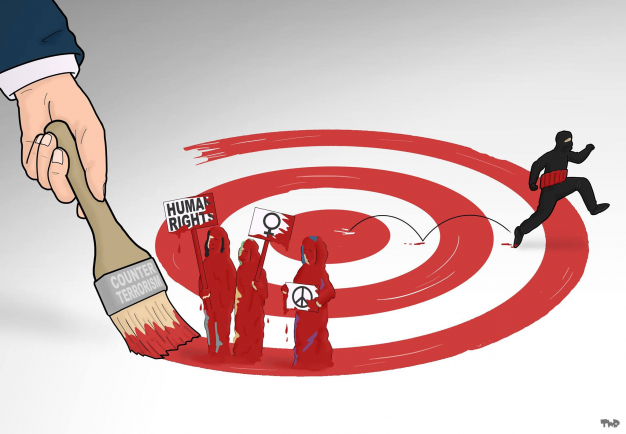

"One of the issues we encountered at the charity/security intersection is banking services for nonprofits that do international work. We began hearing about problems that a few Muslim charities were having with bank account closures about seven years ago and first documented it in 2011, in our report "U.S. Muslim Charities: A Decade in Review". But Muslim charities turned out to be the canary in the coal mine, as one of our members stated. By 2014, we were hearing many more complaints, and not just from Muslim charities. We formed a Financial Access Working Group to bring the problem to the attention of decision-makers in Congress and the Administration and to identify potential solutions. By the spring of 2015, we had hit a roadblock. We could not identify an appropriate, effective solution, without more information."

"Closing accounts was the biggest concern of the organizations we talked to in the beginning, although people were also having problems with getting wire transfers through. We then went to Treasury and Congress and briefed them on our members’ experiences. All they kept saying is that it is an isolated problem, and that there was no data to back up our claim that it is a widespread issue. We realized you could not design a whole solution if you do not understand how widespread it is, with what frequency it is experienced, what kinds of programs are impacted, etc. There were so many unanswered questions. We were not in a position to advocate for a particular solution without the tangible data.

At that stage, the Bill and Melinda Gates Foundation stepped in, to support investigatory research to answer these questions, so that all affected stakeholders – nonprofits, financial institutions and government – would have empirical data to use as the basis to craft solutions that would work. This research was designed to inform stakeholders about each other’s concerns and experiences, to explain the context in which nonprofits are experiencing financial access problems, and to assess some potential solutions that may provide relief. U.S. organizations that work internationally are required to file a special form with the Internal Revenue Service (IRS). This group of organizations provided the pool we took our sample from. We worked with a university to design the survey, pull the random sample and conduct the phone interviews. To get the high response rate, we needed to make the survey short."

"Yes! The numbers came back, and we were surprised. Two out of every three U.S. organizations working abroad are facing financial access problems. We expected it to be a relatively small number of organizations working in humanitarian aid and those working in conflict hotspots, but it was far more widespread. Account closures were not the biggest problem, wire transfer delays were. Many of the respondents are resorting to carrying cash, which is a concern. Getting the empirically sound data has been worth the headaches of collecting it, because people are no longer questioning that this is a problem. No one has challenged the data."

"We did not ask about it specifically. I will say in looking back at the focus groups, it’s like the rest of the NPO world. The number of women running NPOs is huge; that’s the only aspect of gender that we have observed. Accumulating knowledge on the gender aspect of this issue will become an important part of the conversation."

"If there is any easing of rules it should include rules that will give banks an incentive to serve NGOs --removing unreasonable restrictions for all stakeholders, not just for banks, and not at the expense of NGOs."

"That’s always a problem. What’s interesting about it now is that the advent of the Risk Based Approach (RBA) [2] shakes up the system in the United States. Although U.S. officials have expressed support for the RBA as policy, it is not yet a legal standard. The current law sets a strict liability for sanctions violations or material support [3]; there is nothing that could be exempt. Only medicine and religious materials are allowed. Theoretically, you could be prosecuted if a person who is a member of a terrorist organization gets a meal you provide, or you pay a fee to some vender who turns out to be a member of one of these groups. Unlike strict liability, the RBA entails that you are accepting some level of risk. It is not a zero tolerance scheme.

So there is an inherent incoherence between the current law and RBA. President Obama did apply an RBA to enforcement, which means NGOs that were trusted would not be prosecuted under the material support laws. It provided a common law standard that legitimate organizations weren’t going to be targeted. For a bank, however, that’s a risk they’re not willing to take. There is nothing to give them an incentive to take the perceived risk of one of these transfers. They are in the same position as NGOs, with the lack of clarity and threat of sanctions. NGOs are stuck in the middle of RBA and strict liability. There is now an accumulation of knowledge on the problem, which will help push it forward. It is a financial inclusion problem, and it is a global problem."

"We missed a lot of donors in the sample because we didn’t survey private foundations. However, we did speak to many public charity centers that make grants. A lot of charities work with local partners, and the money flow is very similar to that of a foundation. There needs to be follow-up on this topic. They had concerns on behalf of their grantees, who are having financial access problems. Those who are trying to do transfers overseas are asked for so much extra information and experience significant delays in wire transfers, up to several weeks or even months. They are asked for very personal information about donors and their officials, in some cases even for information on donor officials’ family members.

In terms of how they cope, some dropped a program, for example in Afghanistan. For the most part they kept on pushing to accomplish their mission. That’s what impressed me most of the nonprofits in the survey: two-thirds facing issues with financial access, and 42 percent carrying cash, and only 3 percent dropping a program. Civil society does not de-risk."

"The feedback we have received on the research has been focused on solutions and has been positive. That’s the conversation that should be taking place. That was also our major goal with getting the report out there. One thing to keep in mind is that our research shows the big broad picture and everything is weighed equally in terms of the numbers, but we know humanitarian assistance is a life saving question. If their bank account is closed, it has a much more dramatic impact than if a sports team has to take cash to pay for their tournament.

One of our suggestions is that there be a special channel during humanitarian crises when the regular banking system cannot or will not handle the transfers. A concern with this temporary remedy, however, is that we might solve that problem, and the rest they will leave as-is. I have a concern that the broader problem will not be addressed if we only address the humanitarian aspect. The NGOs I have talked to are insistent that it is all kinds of programs that are affected. Most of these groups run multiple types of programs, and so even if an emergency measure like this can help groups with one type of program, the others will still have problems.

In addition, the World Bank has created work streams to pursue solutions for NGO financial access problems. It will explore standardization for information that banks would need, this would speed things up. We are currently also engaging with the U.S. Treasury. Their initial interpretation of the data was that because it shows that wire transfer delays and requests for additional information are the biggest problem, this shows that the RBA is working. While that may be true in some cases, the examples we collected show that information requests are often inefficient at best and overly intrusive at worst. We think this has negative consequences for civil society financial access and needs to be addressed."

"The terms green list (controlled by civil society) vs. white list (controlled by the government) were being thrown around really loosely, and we wanted to make the distinction clear. A green list would be accessible, and would be opt-in. It has to work for smaller organizations, and it needs to be controlled by civil society and not the government. CSOs have other self-regulatory approaches, from different standards, and that’s the kind of model we would like to see. The sheer volume of financial transactions conducted internationally makes a case-by-case review of transactions a guarantee of delay. If there’s a database where a bank could login and get all of the information, it could save a huge amount of time. That could be done between CSOs and banking institutions without government participation.

We need standardized criteria by NPOs to squeeze out companies like World Check[5]. The use of World Check and similar services by banks continues to be a big problem. We need to think about how we can discredit reliance on that, and promote reliance on what we put together as being better information. Civil society would approve the criteria, and all of that information would be available. One of the issues in discussion that has to be figured out is to what extent financial institutions could rely on the information in a repository, and if they would still want or need to independently investigate. That’s practically impossible, and would result in the same level (or perhaps even worse) of backlogs and delays. For the green list to work, there needs to be an assumption that the banks can rely on that in good faith. There needs to be a standardizing of communication flows, because in conversations with the banks, they say when an organization makes transfers that are out of their usual pattern, that is a red flag. There should be a process by which you would notify the bank ahead of time."

"In terms of the data, it would be difficult to translate it to countries outside of the United States. You would need to adapt the questions. You would also need to have a database available from your regulator or large umbrella organization that has enough basic information that you can analyze. Or some kind of mailing list with a high response rate, or an umbrella organization that could make statements about their membership."

[1] Reuters. 16/02/2017 Big U.S. banks to push for easing of money laundering rules http://www.reuters.com/article/us-usa-banks-moneylaundering-exclusive-idUSKBN15V1E9

[2] The Risk-Based Approach was introduced by the Financial Action Task Force (FATF) in 2007 to help ensure that measures to prevent money laundering and terrorist financing threats are commensurate to the risks identified. The FATF is the intergovernmental body that sets global standards to combat money laundering and terrorist financing. The intention of the RBA was to create a more pragmatic, flexible and rational approach in which the focus shifted to address actual risks through controls based on customers and the precise risks they posed, as opposed to strict liability. A series of guidance documents describes how various sectors, including FIs and governments, could implement the RBA. See Financial Access Task Force, “Guidance for a Risk-Based Approach: Effective Supervision and Enforcement by AML/CFT Supervisors of the Financial Sector and Law Enforcement,” October 2015, http://www.fatf-gafi.org/media/fatf/documents/reports/RBA-Effective-supervision-and-enforcement.pdf ; Financial Access Task Force, “Guidance for a Risk-Based Approach: The Banking Sector,” October 2014, http://www.fatf-gafi.org/media/fatf/documents/reports/Risk-Based-Approach-Banking-Sector.pdf

[3] Material Support Law in the U.S. https://www.law.cornell.edu/uscode/text/18/2339A

[4] A green ist would be a database “that is operated by an independent entity, such as an NPO or consortium of stakeholders—in order to avoid making the government a gatekeeper to NPO financial access (“white list”). However, one or more government agencies would need to give FIs assurance that they can rely on the information in conducting their due diligence. NGO Source, a repository used by international grantmakers, provides a useful model for such a regulatory greenlight”. Page 98 http://www.charityandsecurity.org/system/files/FinancialAccessFullReport_2.21%20%282%29.pdf

[5] Vice News. 04/02/2016 Vice News Reveals the Terrorism Blacklist Secretly Wielding Power Over the Lives of Millions. https://news.vice.com/article/vice-news-reveals-the-terrorism-blacklist-secretly-wielding-power-over-the-lives-of-millions

The Charity & Security Network is a resource center for nonprofit organizations to promote and protect their ability to carry out effective programs that promote peace and human rights, aid civilians in areas of disaster and armed conflict and build democratic governance.

The Charity & Security Network is a resource center for nonprofit organizations to promote and protect their ability to carry out effective programs that promote peace and human rights, aid civilians in areas of disaster and armed conflict and build democratic governance.

Find the website of C&SN here

Find the Executive Summary of the report here

Find the entire report here

11 Dec '17 This month WPP staff interviewed Arbia Jebali and Sarah Chamekh from Free Sight Association in Tunisia about the work their organization does, how civil society space has changed over the years, which challenges they are facing now, and how civil society in Tunisia is organizing itself to overcome those challenges.

7 Nov '17 In this article, WPP staff interviewed Doron Joles of XminY Fund, an activist organization that supports social movements, action groups and changemakers fighting for a fair, democratic, sustainable and accepting world. He discusses the unique way they have chosen to hand out funds, and the challenges that go along with funding small activist organizations in the current global climate.

25 Oct '17 This Friday, the UNSCR 1325 Open Debate will take place once again, seventeen years since the adoption of landmark UN Security Council Resolution 1325 on Women, Peace and Security. In this article WPP staff reflects on the progress made for a truly transformative feminist peace agenda until now.